Did you know that your home can be an excellent source of funds? Tapping your home equity can be a low-cost way to borrow large sums at favorable interest rates in order to pay for home projects or debt consolidation. Home equity debt is not a good way to fund recreational expenses or routine monthly bills.

You’ll want to choose wisely how you utilize these funds, but given the incredibly low interest rates, now would be a perfect time to consider this option. Here are some of the most common ways to access the equity in your home: a Second Mortgage or Home Equity Loan, a Home Equity Line of Credit (HELOC), and a Cash-Out Refinance. Here’s a link to the differences between these options. The best option for you will depend on your financial situation and future plans.

The smartest strategy for accessing your home equity really depends on what you want to do with the money. Some examples are: lump-sum expenses or debt consolidation; home improvements or starting a business; pay-off high interest loans or credit cards. These options can be extremely helpful for anyone saddled with unexpected financial challenges. Home equity debt can also be a good way to invest in the future. The key is to make sure that you are borrowing at the lowest possible interest rate. Rates are now at historic lows.

A Cash-Out Refinance was a personal option for my wife and myself. As interest rates started to decline, we opted to refinance our first home, which we still own. We were able to pay off some credit card debt, and more importantly, we were able to use some as a down payment toward the purchase of a second home.

If you’d like to learn more about what your current home value is and how to make it work for you, I’d love to be a resource for information or to connect you with a mortgage advisor to help you unlock some of the equity in your home.

Impressions of Home

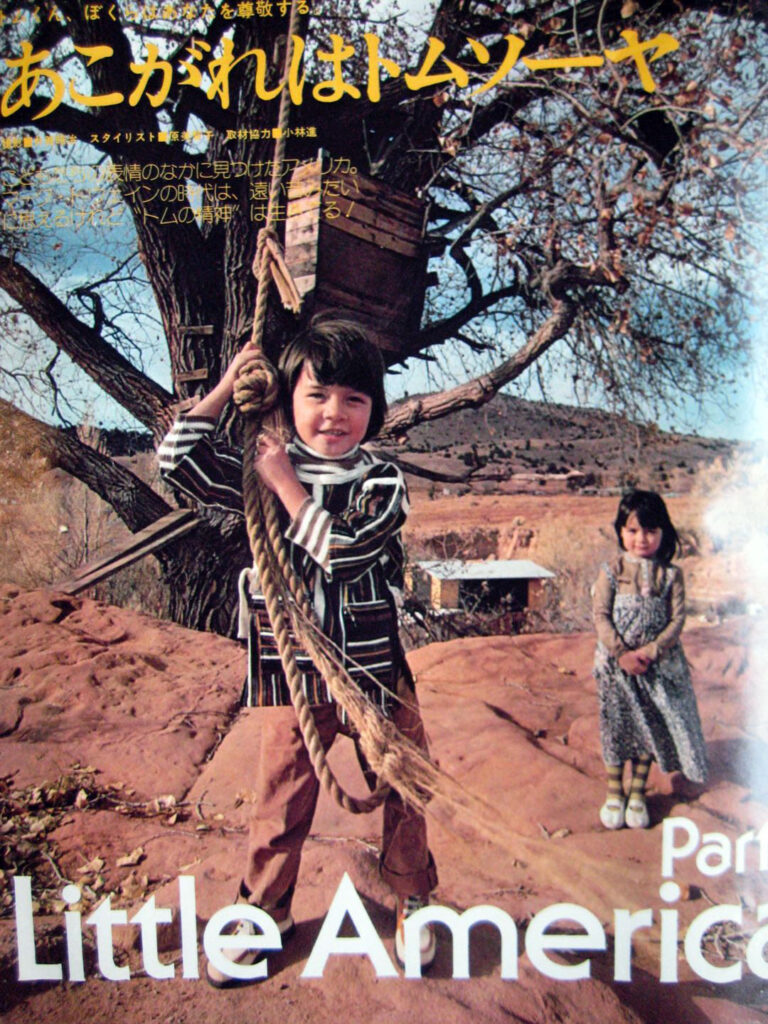

Perhaps some of my fondest childhood memories are from our family home in La Cienega, a rural community just outside of Santa Fe, New Mexico. The home itself was a traditional adobe with a maze-like floor plan, flag-stone floors, creative built-ins and seven fireplaces! None of the fireplaces had dampers (= bad energy score!) and there was a cracked viga (traditional wooden beam) that worried us all … gotta tend to those home repairs! But what captured me most was the surrounding 2.5 acres and beyond. Running alongside the home was an irrigation canal filled with pollywogs and wild spearmint. Next to the canal an enormous cottonwood tree and treehouse with a perilous entry over a cliff. We had endless dirt hills for forts and Big Wheels and a creek where we’d build dams and go fishing. It was a truly magical place to grow up.

La Cienega, New Mexico • 3 bed 2 bath 7 fireplaces 3658 sq. ft. 2.5 acres.

This house was purchased for $43,500 in 1975. Now valued at $471,000.

The purported interest rate back then was near 9%.

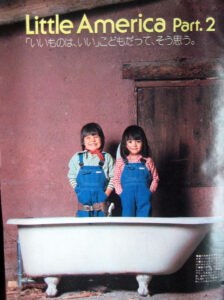

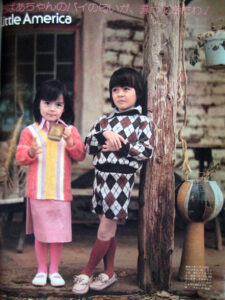

My father once arranged for my sister and I to play Zoolander and model some clothes for a Japanese children’s fashion magazine called SESAME. The photographers chose our home as a backdrop for many of the photos. Below you can see the sketchy treehouse above the cliff and irrigation canal and an old claw-foot bathtub my parents eventually installed in another home. I don’t recall receiving any dough or threads for my hard work, and I can guarantee you I haven’t dressed this well since. Just glad they captured my happy mug!

Please feel free to reach out if you have any questions about what your home equity can do for you.