WHY SO MANY PEOPLE ARE MOVING TO OREGON AND WHAT I THINK ABOUT IT

“Nancy Drew and the Jewel Stealing Sasquatch That Moved to Oregon”

“Nancy Drew and the Jewel Stealing Sasquatch That Moved to Oregon”

If this were The Hardy Boys or Nancy Drew (I devoured those books as a kid) then I would start this case by hunting for clues. There would inevitably be some type of jewels, paintings, or other objects involved and I would almost certainly get to travel to interesting locations. At some point I would get to ride in a spectacular car, motorcycle, boat, plane, or other oddball method of transport like a Sasquatch or something. In the end, my master sleuthing would uncover the mystery, plus some unexpected twist no one was expecting (or maybe I’m thinking of Scooby Doo).

Figuring out why Oregon is one of the top moving destinations in the United States takes a super sleuth. Some reasons are obvious. People from more expensive areas, like much of California, enjoy moving to Portland because they have a lot more buying power. Their jobs also tend to transfer well to our market. Many companies are opening PDX satellite offices and have found that their employees are jumping at the chance to move up here (I’m looking at you, Google).

There is no denying that you can afford more house in Portland than you can in the heavily populated areas of California. The median home price in San Francisco is north of 1.3M. I’ve seen headhunter after headhunter try to recruit many of my engineer friends to move down there (unsuccessfully). The running “joke” is that a down payment in Silicon Valley could buy you an entire house in most of the rest of the United States.

This is California. If it were Oregon these people would be wearing Smartwool long johns, Pendleton sweaters, Columbia jackets, and Patagonia puffer coats. And they’d still be huddled a lot closer together for warmth.

This is California. If it were Oregon these people would be wearing Smartwool long johns, Pendleton sweaters, Columbia jackets, and Patagonia puffer coats. And they’d still be huddled a lot closer together for warmth.

But, as much as Oregonians love to blame all problems (especially traffic) on Californians and people living in Vancouver, there is a deeper story here.

California’s net gain/loss is actually pretty close to zero (about the same amount of people move in as move out). Oregon, on the other hand, stands at about a 67% gain vs 33% loss rate. It seems that word has traveled far and wide. People from Arizona, Texas, Colorado, Illinois, Kentucky, West Virginia, and others are all finding their way to the Pacific Northwest (Seattle is getting them, too).

However, one of the biggest sources of transplants is New York and other northeast states. New York itself is one of the most moved from states at a 63% loss vs 37% gain rate. It’s easy to see why this would happen. All the reasons Californians love to move here make sense for New Yorkers. And unlike Southern Californians, East Coasters aren’t trading year-round mild weather for the privilege of growing webbing between their toes.

Pro tip(s) for migrators: Only wimps carry umbrellas in Oregon. Never buy a piece of outerwear without a hoodie. Beards are not optional.

Pro tip(s) for migrators: Only wimps carry umbrellas in Oregon. Never buy a piece of outerwear without a hoodie. Beards are not optional.

Although, they’ll still have to grow webbing between their toes.

They’re also going to have to deal with an ongoing housing crisis. But that’s another story.

Even though the majority of people move to Oregon for a job (52.75%), there are other reasons. The next most cited response is retirement (19.90%) and people over the age of 65 are actually the largest age group moving to Oregon (24.35%). Although it’s fairly even across the board.

Oregon doesn’t seem like the most likely place to retire but when you factor in Bend, Sisters, Ashland, and the entirety of the coast, it does make sense. Not to mention the fact that we have some kickin’ retirement communities around the Portland metro area.

Family and Lifestyle round out the other major reasons people move to Oregon. Family will always be a good reason to move but not every state offers quite the same lifestyle as Oregon. Whether you want to start a tech company, keep it weird, or follow your outdoor adventure dreams, we’ve got it all.

Weather wasn’t a survey option but I’m sure if it had been, that would have been the top response, right? Or the prevalence of bicycle lanes. That would have been way up there.

This isn’t a bicycle race. It’s just Portlanders on their normal morning commute.

This isn’t a bicycle race. It’s just Portlanders on their normal morning commute.

So, we have a pretty good idea now of why so many people are moving here. The next question would be: Is this a good thing?

I would have to say, “YES!” Many of the people moving here are accepting jobs that sorely need to be filled. Because companies are beginning to realize that Oregon is more than just the end destination of their favorite 80’s computer game, the job market is booming. We’ve been setting records for job growth and we need talent, stat.

Of course, we also need available housing, stat. But, that’s still another story.

Full disclosure: I am not a native Oregonian. I moved here in 2001 from my home state of Georgia. I have an enormous soft spot for anyone from the eastern seaboard because I worked sales for years to New York and the surrounding states. For some reason, my straight-forward, analytical, “get ‘er done” personality jives well with New Yorkers. I sometimes miss traveling back there and being able to visit 6 states in a day (although I don’t miss the tolls).

So if you’re looking to transplant yourself to the Portland area, look me up. We’ll see all kinds of interesting locations, maybe weather a few twists, and eventually uncover a jewel of a home. But no Sasquatches. I promise.

The joy of understanding zoning.

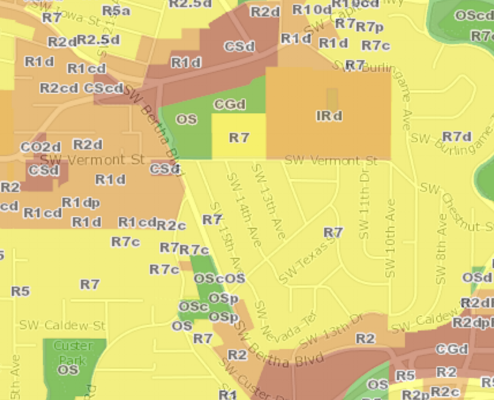

The joy of understanding zoning. This is a zone map of a little piece of Portland. You definitely do not need to understand what all this means.

This is a zone map of a little piece of Portland. You definitely do not need to understand what all this means.